AMT/ Innovation in Action:ナレッジ・マネジメントがもたらす新たな価値~門永真紀弁護士、 Financial Times主催Asia-Pacific Innovative Lawyers Award / Legal Intrapreneur賞受賞

AMTは、「Your Partner for Innovative Challenges」という理念を掲げ、多様な専門性を活かし、クライアントの課題解決に向けた革新的なアプローチを追求しています。この理念を象徴する出来事として、2025年5月15日、門永真紀弁護士が同年のFinancial Times主催「Asia-Pacific Innovative Lawyers Award」においてLegal Intrapreneur賞を受賞しました。この受賞は、同弁護士がナレッジ・マネジメントを通じてAMTの業務を変革し、法律業界全体に革新をもたらしたことへの高い評価を示しています。

座談会:エネルギー・トランジションの最前線【第2回】国内再生可能エネルギー市場の最新動向-太陽光発電を中心に-

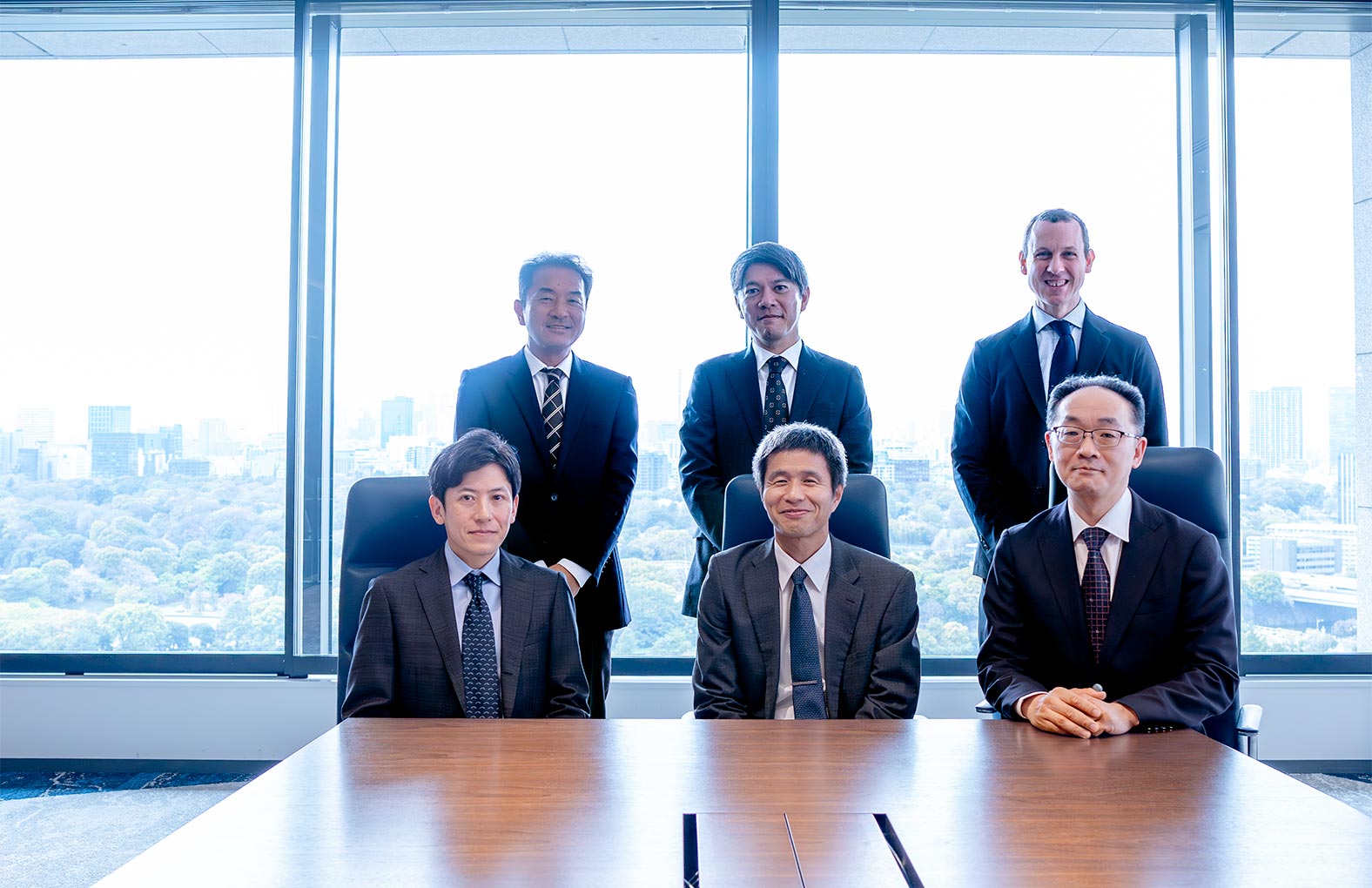

前回のエネルギー分野に関する世界の潮流と日本企業の海外展開に続き、今回は国内の再生可能エネルギー市場、特に太陽光発電の最新動向についてお届けします。本記事では、コーポレートPPAの定着やFIP制度への移行など、市場の主要な流れを解説するとともに、法務面での課題や新たな事業展開の可能性についても専門的見地から分析します。

座談会:エネルギー・トランジションの最前線【第1回】エネルギー分野に関する世界の潮流と日本企業の海外展開

脱炭素社会の実現に向けた世界的な機運の高まりを背景に、クリーンエネルギー分野は急速に発展しています。本座談会では、クリーンエネルギー分野に精通した6名の弁護士が「エネルギー・トランジションの最前線」をテーマに、実務で直面する主要な課題や今後の展望について意見を交わしました。第1回は、エネルギー分野における世界のトレンドを整理した上で、市場の現状と日本企業の海外展開における課題に迫ります。

通商・経済安全保障分野の現代的問題点と経済インテリジェンスの重要性

WTOへの信頼が揺らぎ、自由貿易体制の動揺が見られる一方で、米中対立や地政学的リスクの高まりの結果、通商問題に安全保障の考慮が前面に出されるようになった。グローバルな企業活動の不確実性が増している中で、通商・経済安全保障の法務においては、経済インテリジェンスを集積し、幅と奥行きのあるアドバイスを引き続き提供していく。

エネルギー・トランジション法務と弁護士対談~実務最前線~

エネルギー・トランジションは、2050年カーボンニュートラル達成に不可欠なプロセスです。 本記事では、エネルギー・トランジション分野における当事務所の強みや豊富なサービスメニューをご紹介します。また、実務最前線の知識と経験を持つ弁護士たちによる対談記事も随時掲載し、エネルギー・トランジションに関する最新のホットトピックを深掘りしていきます。

特集:サステナビリティ法務【第13回】名古屋大学・久木田准教授と「AIとサステナビリティ」について考える(名古屋大学大学院情報学研究科 社会情報学専攻 情報哲学・久木田水生准教授×パートナー弁護士・清水亘)

当事務所は、法律家として、いかにSDGsの達成に貢献できるかを模索し続けています。 当事務所は、クライアントの持続可能な成長に向けた法的課題をあらゆる角度からサポートすべく、各専門分野における弁護士がSDGsに関する知見を深め、サステナビリティ法務のベスト・プラクティスを目指します。

AI, Data & Digital

近時、各企業や団体等の事業活動において、AIやブロックチェーン等の新たなデジタル技術や、データの分析・活用による新たな製品・サービスの開発・提供、グローバルな人材マネジメント等の動きが急速に進行し、その重要性がますます高まっています。 一方、日本を含め世界各国のデータ保護規制は複雑化の一途をたどり、また、AIやデジタル・プラットフォーム等に関わる新たなルールの導入やその議論も活発化しています。

ニュースレターをご購読の方に、 事務所主催セミナーの最新情報やご案内をお送りしております。

ニュースレター配信のお申し込み