The act to amend the Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors (the "Subcontract Act"), which will be renamed to the Act Against Delay in Payment of Fees, etc. to Small and Medium-sized Entrusted Business Operators in Manufacturing and Other Specified Fields (the "Amended Act"), will come into effect on January 1, 2026. While the Subcontract Act had undergone numerous minor revisions through previous amendments, the Amended Act represents a comprehensive overhaul that is distinct from those prior revisions. It goes beyond merely altering the act's name, imposing significant changes that compel large procuring enterprises to review their practices and transform their operations.

The main terminology changes under the Amended Act are as follows.

| Current Act | After Amendment |

|---|---|

| Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors (Subcontract Act) | Act Against Delay in Payment of Fees, etc. to Small and Medium-sized Entrusted Business Operators in Manufacturing and Other Specified Fields (also known as the Act on Proper Transactions with Small and Medium-sized Entrusted Business Operators) |

| Large procuring enterprise | Entrusting business operator |

| Subcontractor | Small and medium-sized entrusted business operator |

| Subcontract proceeds | Manufacturing consignment fees |

The amendments to the Subcontract Act cover a wide range of points, but the main points expected to have a significant impact on practical operations are as follows.

| Areas of Revision | Details of Revisions |

|---|---|

|

The scope of business operators subject to the Amended Act has been amended so that aside from the existing capital criteria, new criteria based on the number of employees regularly employed by the business operators have been added. |

|

Transactions relating to the entrustment of transportation services from shippers to transportation operators, which were not previously subject to the Subcontract Act, are now newly subject to the Amended Act. |

|

Under the Subcontract Act, only molds used for manufacturing goods were considered to fall under the scope of manufacturing consignment transactions. However, the Amended Act has revised the definition of "manufacturing consignment" to include wooden molds, jigs, and similar items used exclusively for product creation. |

|

Separate from the provision prohibiting price gouging, a new provision has been established prohibiting the entrusting business operator from unilaterally determining the prices in a manner that unfairly harms the interests of small and medium-sized entrusted business operators. |

|

Payment by promissory note is now completely prohibited. Furthermore, other payment methods, such as electronically recorded claims and factoring, that make it difficult for small and medium-sized entrusted business operators to obtain the full payment amount equivalent to the manufacturing consignment fee (including fees, etc.) by the payment due date are also prohibited. |

|

The scope of payments subject to late payment interest has been expanded such that even if the amount of the manufacturing consignment fee or other similar fees is reduced, the entrusting business operator is still obligated to pay late interest on the reduced amount to the small and medium-sized entrusted business operator. In addition, the Japan Fair Trade Commission can now recommend measures to prevent the recurrence of violations, not only when the entrusting business operator is committing a violation, but also when the violation has already been corrected at the time the recommendation is made. |

Similar to the Subcontract Act, the Amended Act defines the scope of applicable consignment transactions based on both (a) the size of the business operators (the "Size Criteria") and (b) the nature of the transaction (i.e., the type of consignment). It is important to note that the amendments significantly expand the scope of applicable consignment transactions compared to the Subcontract Act, as outlined in points (1) and (2) above.

(a) Size Criteria

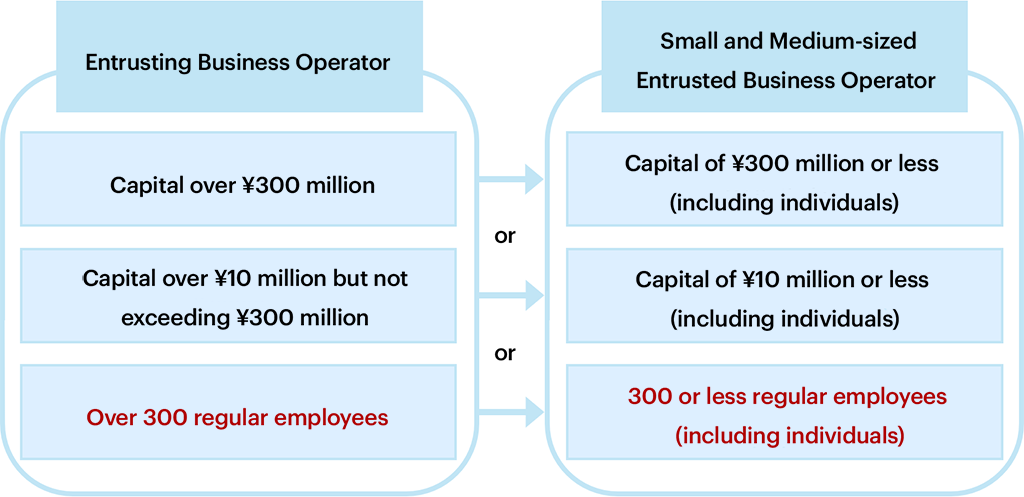

Previously, the Subcontract Act only used a business operator’s capital as the criterion for determining whether such business operator was subject to the Subcontract Act. However, the Amended Act establishes an alternative requirement based on the number of employees regularly employed by the business operator (Article 2, Paragraph 8, Items 5 and 6; Paragraph 9, Items 5 and 6). This employee-based criterion applies when the capital criterion does not apply. Please note that the existing capital criterion remains unchanged. The Size Criteria under the Amended Act are as follows:

- (i) manufacturing, (ii) repair, (iii) information-based product creation (limited to program development), (iv) service contract (limited to transportation, warehousing, and information processing), or (v) specific transportation

- (i) information-based product creation (excluding program development) or (ii) service contract (excluding transportation, warehousing, and information processing)

(b) Nature of the Transaction (I.e., Type of Consignment)

The Subcontract Act applies to 4 categories of consignment: (i) manufacturing, (ii) repair, (iii) information-based product creation, and (iv) service contract. The Amended Act newly adds "Specific Transportation" as a 5th category (Article 2, Paragraphs 5 and 6). Specific transportation refers to the consignment of transportation to the counterparty (including any party designated by such counterparty) in transactions involving the sale, manufacture, repair, or creation of the subject matter (in the case of information products, the item on which the subject information product is recorded, inscribed, or embodied) when the consignor sells, manufactures, repairs, or undertakes the creation of information products as a business.

As outlined above, the amendments under the Amended Act have a significant impact on business practices. Therefore, companies should promptly review their consignment transactions and take appropriate measures.